The New Year is always a motivating time to look at your personal finances and overall budget, am I right? When I asked on Instagram stories what content you wanted to see from me in 2020, personal finance and budgeting was one of them. My first reaction was legit “HAHAHA WHAT?!” (To clarify, I’m not a financial advisor or qualified to give financial advice). But, then on second thought, I felt this question and request made sense. I mean, my girlfriends and I openly talk about our own budgeting strategies. Investing strategies. Organization strategies. We send each other group texts with requests to talk each other OUT OF buying a fancy bag we do not need. So, why not share the ‘girl-next-door’ advice I absorbed from a recent book read?

I’ve always been an incredibly independent person (only child syndrome) and have had a fair grasp of my finances and spending. I’ve also experienced months of paying off a credit card when I’ve overspent on travel or big purchases. BUT I will say I’ve always been interested in (and mildly controlling?) about having a strong grasp of my finances and budget. Overall, as women we NEED TO CARE about our budgets.

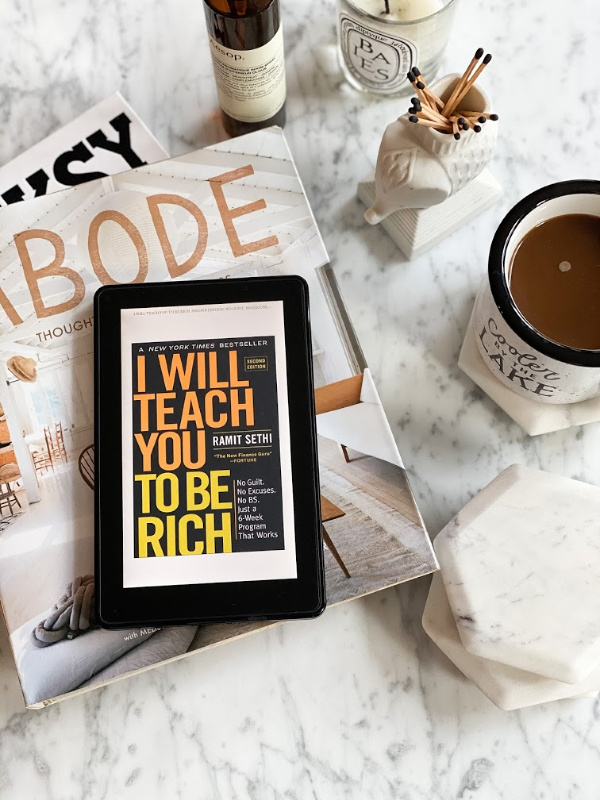

I purchased I Will Teach You To Be Rich when it popped up as a possible interest on my Kindle. The title alone sparked my interest, so I decided to download. The content is absolutely not a ‘get rich quick’ scheme. It makes the topics of budgets, investing and finance interesting and straightforward. The title eludes to defining what YOUR definition of a ‘rich life’ means. Does your rich life mean continuing to live your current lifestyle and just pay off debt quickly? Does your rich life mean being able to travel, save for a future home and kids? Does it mean being able to retire at 45? The author, Ramit, outlines ways to achieve your goals.

A few key pieces of information that I found exceptionally helpful…

ONE // Why you should max out your 401K and ensure you’re hitting your company 401K match. Also, what to do when you have multiple 401Ks from different companies. (He also acknowledges the actual name “401K” is the worst name ever from a Marketing perspective. AGREED.)

TWO // How Roth IRA works and why you should have one in addition to your 401K

THREE // How to develop a savings plan that works for you and think ahead to big purchases

One of my favorite quotes from the book that made me laugh out loud… Question: “I ordered a small coffee instead of a large, so I’m saving X dollars a day. Am I adulting?” Response: “You will die alone.”

Ha! If you’re worrying about the $2 different between a large and small coffee but avoiding opening a Roth account or a savings account because it seems confusing, you’re really missing out on where the passive money making magic happens.

So, what does my ‘rich life’ include? I’ve realized that budgeting for work outs and fitness classes is very important and makes me happy in day-to-day life. My ‘rich life’ includes saving for a future home purchase. It’s about the mental freedom of not being in debt. It’s the ability to take a weekend trip on a whim if we need to get away. And yes, it’s about buying a $5 oatmilk latte when I want and not feeling guilty about it.

Overall, I feel strongly that everyone can benefit from this book! It’s motivating and funny and digestible all at once. Let me know if you’ve already read it or if it’s on your list!

Comments